Audit Program Best Practices: Part 2

Audits provide an essential tool for improving and verifying compliance performance. As discussed in Part 1, there are a number of audit program elements and best practices that can help ensure a comprehensive audit program. Here are 12 more tips to put to use:

- Action item closure. Address repeat findings. Identify patterns and seek root cause analysis and sustainable corrections.

- Training. Training should be done throughout the entire organization, across all levels:

- Auditors are trained on both technical matters and program procedures.

- Management is trained on the overall program design, purpose, business impacts of findings, responsibilities, corrections, and improvements.

- Line operations are trained on compliance procedures and company policy/systems.

- Communications. Communications with management should be done routinely to discuss status, needs, performance, program improvements, and business impacts. Communications should be done in business language—with business impacts defined in terms of risks, costs, savings, avoided costs/capital expenditures, benefits. Those accountable for performance need to be provided information as close to “real time” as possible, and the Board of Directors should be informed routinely.

- Leadership philosophy. Senior management should exhibit top-down expectations for program excellence. EHSMS quality excellence goes hand-in-hand with operational and service quality excellence. Learning and continual improvement should be emphasized.

- Roles & responsibilities. Clear roles, responsibilities, and accountabilities need to be established. This includes top management understanding and embracing their roles/responsibilities. Owners of findings/fixes also must be clearly identified.

- Funding for corrective actions. Funding should be allocated to projects based on significance of risk exposure (i.e., systemic/preventive actions receive high priority). The process should incentivize proactive planning and expeditious resolution of significant problem areas and penalize recurrence or back-sliding on performance and lack of timely fixes.

- Performance measurement system. Audit goals and objectives should be nested with the company business goals, key performance objectives, and values. A balanced scorecard can display leading and lagging indicators. Metrics should be quantitative, indicative (not all-inclusive), and tied to their ability to influence. Performance measurements should be communicated and widely understood. Information from auditing (e.g., findings, patterns, trends, comparisons) and the status of corrective actions often are reported on compliance dashboards for management review.

- Degree of business integration. There should be a strong link between programs, procedures, and methods used in a quality management program—EHS activities should operate in patterns similar to core operations rather than as ancillary add-on duties. In addition, EHS should be involved in business planning and MOC. An EHSMS should be well-developed and designed for full business integration, and the audit program should feed critical information into the EHSMS.

- Accountability. Accountability and compensation must be clearly linked at a meaningful level. Use various award/recognition programs to offer incentives to line operations personnel for excellent EHS performance. Make disincentives and disciplinary consequences clear to discourage non-compliant activities.

- Deployment plan & schedule. Best practice combines the use of pilot facility audits, baseline audits (to design programs), tiered audits, and a continuous improvement model. Facility profiles are developed for all top priority facilities, including operational and EHS characteristics and regulatory and other requirements.

- Relation of audit program to EHSMS design & improvement objectives. The audit program should be fully interrelated with the EHSMS and feed critical information on systemic needs into the EHSMS design and review process. It addresses the “Evaluation of Compliance” element under EHSMS international standards (e.g., ISO 14001 and OHSAS 18001). Audit baseline helps identify common causes, systemic issues, and needed programs. The EHSMS addresses root causes and defines/improves preventive systems and helps integrate EHS with core operations. Audits further evaluate and confirm performance of EHSMS and guide continuous improvement.

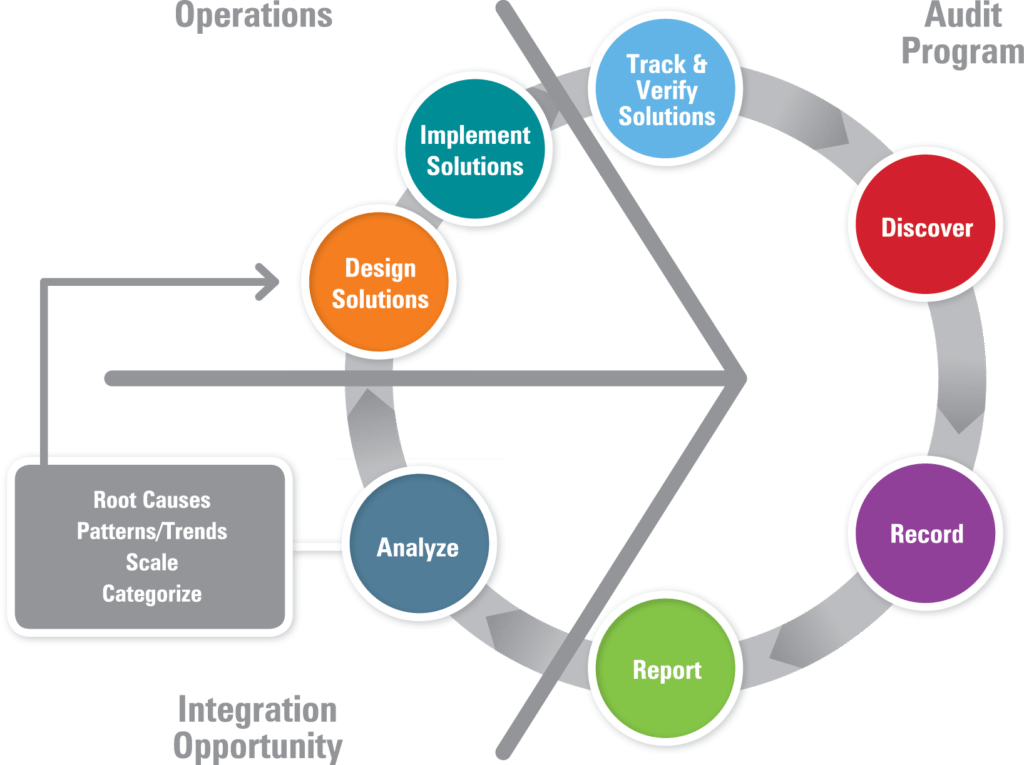

- Relation to best practices. Inventory best practices and share/transfer them as part of audit program results. Use best-in-class facilities as models and “problem sites” for improvement planning and training. The figure below illustrates an audit program that goes beyond the traditional “find it, fix it, find it, fix it” repetitive cycle to one that yields real understanding of root causes and patterns. In this model, if the issues can be categorized and are of wide scale, the design of solutions can lead to company-wide corrective and preventive measures. This same method can be used to capture and transfer best practices across the organization. They are sustained through the continual review and improvement cycle of an EHSMS and are verified by future audits.

Read the part 1 audit program best practices.

Audit Program Best Practices: Part 1

Audits provide an essential tool for improving and verifying compliance performance. Audits may be used to capture regulatory compliance status, management system conformance, adequacy of internal controls, potential risks, and best practices. An audit is typically part of a broader compliance assurance program and can cover some or all of the company’s legal obligations, policies, programs, and objectives.

Companies come in a variety of sizes with a range of different needs, so auditing standards remain fairly flexible. There are, however, a number of audit program elements and best practices that can help ensure a comprehensive audit program:

- Goals. Establishing goals enables recognition of broader issues and can lead to long-term preventive programs. This process allows the organization to get at the causes and focus on important systemic issues. It pushes and guides toward continuous improvement. Goal-setting further addresses the responsibilities and obligations of the Board of Directors for audit and oversight and elicits support from stakeholders.

- Scope. The scope of the audit should be limited initially (e.g., compliance and risk) to what is manageable and to what can be done very well, thereby producing performance improvement and a wider understanding and acceptance of objectives. As the program is developed and matures (e.g., Management Systems, company policy, operational integration), it can be expanded and, eventually, shift over time toward systems in place, prevention, efficiency, and best practices.

- Committed resources. Sufficient resources must be provided for staffing and training and then applied, as needed, to encourage a robust auditing program. Resources also should be applied to EHSMS design and continuous improvement. It is important to track the costs/benefits to compare the impacts and results of program improvements.

- Operational focus. All facilities need to be covered at the appropriate level, with emphasis based on potential EHS and business risks. The operational units/practices with the greatest risk should receive the greatest attention (e.g., the 80/20 Rule). Vendors/contractors and related operations that pose risks must be included as part of the program. For smaller, less complex and/or lower risk facilities, lower intensity focus can be justified. For example, relying more heavily on self-assessment and reporting of compliance and less on independent audits may provide better return on investment of assessment resources.

- Audit team. A significant portion of the audit program should be conducted by knowledgeable auditors (independent insiders, third parties, or a combination thereof) with clear independence from the operations being audited and from the direct chain of command. For organizational learning and to leverage compliance standards across facilities, it is good practice to vary at least one audit team member for each audit. Companies often enlist personnel from different facilities and with different expertise to audit other facilities. Periodic third-party audits further bring outside perspective and reduce tendencies toward “home-blindness”.

- Audit frequency. There are several levels of audit frequency, depending on the type of audit:

- Frequent: Operational (e.g., inspections, housekeeping, maintenance) – done as part of routine EHSMS day-to-day operational responsibilities

- Periodic: Compliance, systems, actions/projects – conducted annually/semi-annually

- As needed: For issue follow-up

- Infrequent: Comprehensive, independent – conducted every three to four years

- Differentiation methods. Differentiating identifies and distinguishes issues of greatest importance in terms of risk reduction and business performance improvement. The process for differentiating should be as clear and simple as possible; a system of priority rating and ranking is widely understood and agreed. The rating system can address severity levels, as well as probability levels, in addition to complexity/difficulty and length of time required for corrective actions.

- Legal protection. Attorney privilege for audit processes and reports is advisable where risk/liability are deemed significant, especially for third-party independent audits. To the extent possible, make the audit process and reports become management tools that guide continuous improvement. Organizations should follow due diligence elements of the USEPA audit policy.

- Procedures. Describe and document the audit process for consistent, efficient, effective, and reliable application. The best way to do this is to involve both auditors and those being audited in the procedure design. Audit procedures should be tailored to the specific facility/operation being audited. Documented procedures should be used to train both auditors and those accountable for operations being audited. Procedures can be launched using a pilot facility approach to allow for initial testing and fine-tuning. Keep procedures current and continually improve them based on practical application. Audits include document and record review (corporate and facility), interviews, and observations.

- Protocols & tools. Develop specific and targeted protocols that are tailored to operational characteristics and based on applicable regulations and requirements for the facility. Use “widely accepted or standard practice” as go-by tools to aid in developing protocols (e.g., ASTM site assessment standards; ISO 14010 audit guidance; audit protocols based on EPA, OSHA, MSHA, Canadian regulatory requirements; GEMI self-assessment tools; proprietary audit protocol/tools). As protocols are updated, the ability to evaluate continuous improvement trends must be maintained (i.e., trend analysis).

- Information management & analysis. Procedures should be well-defined, clear, and consistent to enable the organization to analyze trends, identify systemic causes, and pinpoint recurring problem areas. Analysis should prompt communication of issues and differentiation among findings based on significance. Audit reports should be issued in a predictable and timely manner. It is desirable to orient the audit program toward organizational learning and continual improvement, rather than a “gotcha” philosophy. “Open book” approaches help learning by letting facility managers know in advance what the audit protocols are and how the audits will be conducted.

- Verification & corrective action. Corrective actions require corporate review, top management-level attention and management accountability for timely completion. A robust root cause analysis helps to ensure not just correction/containment of the existing issue, but also preventive action to assure controls are in place to prevent the event from recurring. For example, if a drum is labeled incorrectly, the corrective action is to relabel that drum. A robust plan should also look for other drums than might be labeled incorrectly and to add and communicate an effective preventive action (e.g., training or posting signs showing a correctly labeled drum).

Read the part 2 audit program best practices.

10 Reasons to Implement a Management System

A management system is the framework that enables companies to achieve their operational and business objectives through a process of continuous improvement. In its simplest form, a management system implements the Plan, Do, Check, Act/Adjust cycle. Several choices are available for management systems (ISO is commonly applied), whether they are certified by third-party registrars and auditors, self-certified, or used as internal guidance and for potential certification readiness.

Business Benefits of a Well-Documented Management System

The connection between management systems and compliance is vital in avoiding recurring compliance issues and in reducing variation in compliance performance. In fact, reliable and effective regulatory compliance is commonly an outcome of consistent and reliable implementation of a management system.

Beyond that, there are a number of business reasons for implementing a well-documented management system (environmental, safety, quality, food safety, other) and associated support methods and tools:

- Establishes a common documented framework to achieve more consistent implementation of compliance policies and processes—addressing the eight core functions of compliance:

- Inventories

- Permits and authorizations

- Plans

- Training

- Practices in place

- Monitoring and inspection

- Records

- Reporting

- Provides clear methods and processes to identify and prioritize risks, set and monitor goals, communicate those risks to employees and management, and allocate the resources to mitigate them.

- Shifts from a command-and-control, centrally driven function to one that depends heavily on teamwork and implementation of a common system, taking into consideration the necessary local differences and building better know-how at the facility level.

- Establishes a common language for periodic calls and meetings among managers, facility managers, and executives, which yields better goal-setting, priority ranking, and allocation of resources to the areas with greatest risk or the greatest opportunity to add business value.

- Empowers facilities to take responsibility for processes and compliance performance without waiting to be told “what” and “how”.

- Enables better collaboration and communication across a distributed company with many locations.

- Enables the selection and implementation of a robust information system capable of tracking and reporting on common activities and performance metrics across the company.

- Employs a design and implementation process that builds company know-how, captures/retains institutional knowledge, and enables ongoing improvement without having to continually reinvent the wheel.

- Creates consistent processes and procedures that support personnel changes (e.g., transfers, promotions, retirements) and training of new personnel without causing disruption or gaps.

- Allows for more consistent oversight and governance, yielding higher predictability and reliability.

Environment / Quality / Safety

Comments: No Comments

Six Best Practices for Compliance Assurance

A well-designed and well-executed compliance assurance program provides an essential tool for improving and verifying business performance and limiting compliance risks. Ultimately, however, a compliance program’s effectiveness comes down to whether it is merely a “paper program” or whether it is being integrated into the organization and used in practice daily.

The following can show evidence of a living, breathing program:

- Comprehensiveness of the program

- Dedicated staff and resources

- Employee knowledge and engagement

- Management commitment and employee perception

- Internal operational inspections, “walk-abouts” by management

- Independent insider, plus third-party audits

- Program tailoring to greatest risks

- Consistency and timeliness of exception (noncompliance/nonconformance) disclosures

- Tracking of timely and adequate corrective/preventive action completion

- Progress and performance monitoring

Best Practices

To achieve a compliance assurance program on par with world-class organizations, there are a number of best practices that companies should employ:

- Know the requirements. This means maintaining an inventory of regulatory compliance requirements for each compliance program, as well as of state/local/contractual binding agreements applying to operations. It is vital that the organization keep abreast of current/upcoming requirements (federal, state, local).

- Plan and develop the processes to comply. Identify and assess compliance risks, and then set objectives and targets for performance improvement based on top priorities. From here, it becomes possible to then define program improvement initiatives, assign and document responsibilities for compliance (who must do what and when), develop procedures and tools, and then allocate resources to get it done.

- Assure compliance in operations. The organization needs to establish routine checks and inspections within departments to evaluate conformance with sub-process procedures. Process audits should be designed and implemented to cut across operations and sub-processes in order to evaluate conformance with company policies and procedures. Regulatory compliance audits should further be conducted to address program requirements (e.g., environmental, safety, mine safety, security). Audit performance must be measured and reported, and then expectations set for operating managers to take responsibility for compliance.

- Take action on issues and problems. Capture, log, and categorize noncompliance issues, process non-conformances, and near misses. Implement a corrective/preventive action process based on importance of issues. Be disciplined in timely completion, close-out, and documentation of all corrective/preventive actions.

- Employ management of change (MOC) process. Robust MOC processes help ensure that changes affecting compliance (to facility, operations, personnel, infrastructure, materials, etc.) are reviewed for their impacts on compliance. Compliance should be assured before the changes are made. Failure to do so is one of the most common root causes of noncompliance.

- Ensure management involvement and leadership. Set the tone at the top. The Board of Directors and senior executives must set policy, culture, values, expectations, and goals. It is just as important that these individuals are the ones to communicate across the organization, to demonstrate their commitment and leadership, to define an appropriate incentive/disincentive system, and to provide ongoing organizational feedback.

Comments: 2 Comments

ISO 9001:2015 — Major Organizational Changes

The new ISO 9001:2015 standard for Quality Management Systems (QMS) was issued in late 2015—which means the three-year transition period to become certified to the new version is now in full swing. Change can certainly present challenges; however, the ISO 9001:2015 update is designed to simplify the requirements, focus more on business needs, and make the ISO standards more user-friendly.

That being said, organizations will need to make adjustments to their QMS to meet the new requirements. The major impacts that organizations need to consider for ISO 9001:2015 certification include the following:

- Increased management responsibility

- Organizational identification of risks and opportunities

- Impacts of process implementation vs. guidance procedures

- Overhaul of internal audit requirements

Management Responsibility

The increase in management responsibility requires an organization’s objectives and targets to be:

- Business-driven

- More explicit in content

- Reviewed and monitored on a regular basis

Importantly, the QMS must be connected to the business strategy. This involves management taking ownership for the QMS and creating a vision and strategy for the organization, its employees, and customers to follow and interact with in a mutually beneficial manner. The idea is that this will foster a sustainable business plan.

Identification of Risks and Opportunities

The organization must identify and quantify the risks and opportunities presented by each new business endeavor or market driver they seek to enter. This will help management understand the full operational requirements and potential related consequences that must be addressed prior to moving the organization in a new direction.

The process of identifying risks and opportunities involves reviewing and evaluating employee skill sets, equipment capabilities, facility requirements, logistics requirements, environmental and safety risks, and others. In addition, quality control requirements must be reviewed in terms of possible training and equipment needs, and then verified as either adequate or in need of required changes prior to startup.

Process Implementation

The single largest change to the QMS is arguably the notion of written procedures guiding the organization vs. the use of a process approach to enhance the organization’s ability to exhibit systematic control over any/all changes to the products and/or services it provides. This change represents a shift in the approach regarding business operations.

Under a process approach, the management team must:

- Define inputs and outputs of each process

- Determine the correct performance indicator(s) to assure compliance and customer specifications have been met

- Assign appropriate responsibility for these steps

To comply with ISO 9001:2015, the organization must be able to stop a process and rectify the issues of concern prior to a nonconforming product and/or service being given to a customer. As such, employees are empowered to complete a root cause analysis and then notify management of possible change(s) required.

Internal Audit

Corresponding to the process orientation discussed above, the internal audit program will also need to be revamped to go from auditing a single clause to auditing an entire process. This may require additional auditor training for internal auditors, as well as an overall better understanding of the processes the organization follows in its daily business.

The following tips can all help modify the internal audit process to work under the ISO 9001:2015 standard.

- Audit one complete process at a time. This will allow auditors to better assess the process itself, identify possible areas for review and improvement, and verify adequacy of current controls in place.

- Develop flow charts that outline every step in the process(es) and the associated procedures, work instructions, and forms required to assure compliance of each identified step.

- Look for areas throughout the audit where the product and/or service hand-off between departments and equipment cells may be unclear or confusing, leading to a potential nonconformance to the customer.

Big Steps toward Continuous Improvement

While any one of the changes discussed above would represent a significant improvement over the 2008 version of ISO 9001, taken together and implemented properly, the 2015 updates are set up to help organizations take large step towards continuous improvement.

Under ISO 9001:2015, day-to-day operations should:

- Be more functional and harmonious

- Allow for improvements in product and/or service hand-offs between departments

- Improve the consistency of delivering to the customer exactly what is requested

- Reward the organization with improvements to internal functions and lower costs over time

Environment / Food Safety / Quality / Safety / Technology Enabled Business Solutions

Comments: No Comments

Technology Tip: Software and Audits Top 10

All types of business and operational processes demand a variety of audits and inspections to evaluate compliance with standards—ranging from government regulations to industry codes, to system standards (i.e., ISO), to internal corporate requirements.

Audits provide an essential tool for improving and verifying compliance performance. Audits may be used to capture regulatory compliance status, management system conformance, adequacy of internal controls, potential risks, and best practices.

By combining effective auditing program design, standardized procedures, trained/knowledgeable auditors, and computerized systems and tools, companies are better able to capture and analyze audit data, and then use that information to improve business performance. Having auditing software of some sort can greatly streamline productivity and enhance quality, especially in industries with many compliance obligations.

The following tips can help ensure that companies are getting the most out of their auditing process:

- Have a computerized system. Any system is better than nothing; functional is more important than perfect. The key is to commit to a choice and move forward with it. Companies are beginning to recognize the pitfalls of “smart people” audits (i.e., an audit conducted by an expert + notebook with no protocols or systems). While expertise is valuable, this approach makes it difficult to compare facilities and results, is not replicable, and provides no assurance that everything has been reviewed. A defined system and protocol helps to avoid these pitfalls.

- Invest time before the audit. The most important time in the audit process is before the audit begins. Do not wait until the day before to prepare. There is value in knowing the scope of the audit, understanding expectations, and developing question sets/protocol. This is also the time to ensure that the system collects the data desired to produce the final report.

- Capture data. Data is tangible. You can count, sort, compare and organize data so it can be used on the back end. Data allows the company to produce reports, analytics, and standard metrics/key performance indicators.

- Don’t forget about information. Information is important, too. The information provides descriptions, directions, photos, etc. to support the data and paint a complete picture.

- Be timely. Reports must be timely to correct findings and demonstrate a sense of urgency. Reports serve as a permanent record and begin the process of remediation. The sooner they are produced, the sooner corrective actions begin.

- Note immediate fixes. During the audit, there may be small things uncovered that can be fixed immediately. These items need to be recorded even if they are fixed during the audit. Unrecorded items “never happened”. Correspondingly, it is important to build a culture where individuals are not punished for findings, as this can result in underreporting.

- Understand the audience. Who will be reading the final report? What do they need to know? What is their level of understanding? Not all data presentation is useful. In fact, poorly presented data can be confusing and cause inaction. It is important to identify key data, reports desired, and the ways in which outputs can be automated to generate meaningful information.

- Compare to previous audits. The only way to get an accurate comparison is if audits have a common scope and a common checklist/protocol. Using a computerized system can ensure that these factors remain consistent. Comparisons reinforce and support a company’s efforts to maintain and improve compliance over time.

- Manage regulatory updates. It is important to maintain a connection to past audits and the associated compliance requirements at the time of the audit. Regulations might change and that needs to be tracked. Checklists, however, may remain the same. Companies should have a process for tracking regulatory updates and making sure that the system is updated appropriately.

- Maintain data frequency. For data, the frequency is key. Consider what smaller scope, higher frequency audits look like. These can allow the company to gather more data, involve more people, and improve the overall quality and reliability of reports.

A well-designed and well-executed auditing program—with analysis of audit data—provides an essential tool for improving and verifying business performance. Audits capture regulatory compliance status, management system conformance, adequacy of internal controls, potential risks, and best practices. And using a technology tool or system to manage the audit makes that information even more useful.

Environment / Quality / Safety

Comments: No Comments

Management System Internal Audit: What to Expect

Many companies face requirements to conduct management system internal audits. And many probably consider it to be one of those “necessary evils” of doing business. In reality, an internal audit can be a great opportunity to uncover issues and resolve them before an external audit begins. An internal audit can sometimes even enable more improvements than an external audit because it allows the company to review processes more often and more thoroughly. So what, exactly, goes into an internal audit?

What Is an Audit?

First, conducting a management system internal audit encompasses all of the efforts to gather, accumulate, arrange, and evaluate data so that there is sufficient information to arrive at an audit opinion. According to the ANSI/ASQC Standard Q1-1986 Generic Guidelines for Auditing Management Systems, an audit is:

a systematic examination of the acts and decisions by people with respect to Q/EHS issues, in order to independently verify or evaluate and report conformance to the operational requirements of the program or the specification or contract requirement of the product or service.

Internal audits should be carried out to look for areas for improvement and best practices. In an internal audit, the auditor is evaluating, verifying, and reporting conformance or non-conformance in terms of related documentation. The auditor assesses systems, processes, and products against the related documentation:

- Systems are compared against company directives and requirements.

- Processes are compared against procedures, process charts, and work instructions.

The auditor examines where and how “operational requirements of the management system” are described. This is done by reviewing each policy, procedure, work instruction, checklist, and form looking for each “actionable item” listed within.

The Interview

The auditor will go out into the workforce and ask the prepared questions to various employees. Based on the responses given, the auditor may need to ask follow-up questions to get a clear understanding of how an operation works. Questions asked by auditors are generally open-ended to give the auditee the opportunity to elaborate. The auditor’s goal is to give the employee the opportunity to think prior to answering and to follow the audit trail wherever it leads—within or outside of the department.

Tangible Evidence

In order for an internal audit to support improvement steps, the auditor will seek tangible evidence. For example, work instructions require that inspections are completed every day, but the checklist shows that no checks have been performed for the last week. Tangible evidence may include taking a photo copy of the checklist to document this issue.

Evaluating Internal Controls

During the audit, the auditor is looking for internal controls that regulate an operation. There are seven steps in evaluating internal controls:

- Observe the Operation: The auditor needs to understand what processes and systems to review, where they are located, and who is responsible for them.

- Identify Constraints: The auditor will identify constraints to the extent possible, such as:

- Scattered information

- Internal opposition

- Process not capable

- Process not in control

- Unavailable information

- Evaluate Risk: The auditor will assess the importance and risk of internal controls not detecting and preventing non-conformances. The auditor will ask personnel being audited and management if there is anything more that could be done to identify and control risk.

- Evaluate the Internal Control Structure: Usually extensive internal controls exist, operate properly, and maintain/improve the process; however, this may not be an accurate assumption. Controls may not exist, may be weak, or may control and measure unimportant variables. It is very important for the auditor to resist assuming that the way an existing system has been set up is the correct way to do something. Auditors should challenge how and why something is being done to encourage system improvements.

- Test the Effectiveness of the Internal Control Structure: Gathering evidence is the process of collecting data and information critical to support a decision or judgment rendered by the auditor.

- Evaluate Evidence: Once evidence has been gathered from interviews, observations, or records, the auditor must distill and summarize the data into useful information for the company. The evidence is then reviewed to determine whether systems and controls are working effectively.

- Issue an Opinion: When all is said and done, the auditor must issue an opinion of conformance or non-conformance. In a deficiency finding (non-conformance), the audit report will clearly state that there is a variance between what is and what should be. All evidence findings should be listed to support this conclusion.

Clarify Issues and Non-Conformances

Upon completion of an audit, there may be times when clarification of an issue or concern will be warranted. This is when the auditor may go back to the department head and review the current understanding of the audit results. The department head should have ample time to discuss and clarify any issues of concern.

Any outstanding issues that warrant a non-conformance report should be discussed to ensure that the company understands: 1.) why the issue is considered a non-conformance, and 2.) what may need to be done to rectify the situation. It is important to also discuss all positive findings from the audit to leverage best practices.

By using an internal audit to actually improve operations—and not just as another requirement to fulfill—companies can realize significant value through:

- Meeting regulatory/certification requirements prior to the external audit

- Improving operational controls and processes

- Enhancing overall management system effectiveness

Tips to Prepare for an Internal Audit

All types of business and operational processes demand a variety of audits and inspections to evaluate compliance with standards—ranging from government regulations, to industry codes, to system standards (e.g., ISO), to internal corporate requirements. Audits offer a systematic, objective tool to assess compliance across the workplace and to identify any opportunities for improvement.

Routine internal audits are becoming a larger part of organizational learning and development. They provide a valuable way to communicate performance to decision makers and key stakeholders. Even more importantly, audits help companies identify areas of noncompliance and opportunities for improvement.

For some audits, a company may work with a third-party auditor. This can be valuable in getting an objective assessment of overall compliance status if executed effectively. Here are some best practice tips to help prepare for an internal audit—and ensure that it goes smoothly:

- Audit scope: Make sure that the scope of the audit is well defined and documented (i.e., regulations, management system standards, company policies). This also involves identifying which areas and functions onsite are included. For example, if contractors are leasing space, are their areas in scope or out? What about other onsite lessees, if any?

- Documents, plans, and records: Prior to the audit, ask the auditor for a list of documents they may be looking for (e.g., OSHA logs, past audit findings). Depending on the nature of the audit, it can be an extensive list and knowing ahead of time will save time and money. If possible, collect all records in advance and have them easily accessible. If corporate policy allows, it is often advisable to send current versions of all facility-specific plans, permits, and other documents to the auditor in advance of the audit to aid in preparation and create a more efficient use of time onsite. When the auditor arrives, make sure you know where relevant records are and that they are available to the auditor (i.e., not locked up in someone else’s office). Records should be organized by type in separate folders and sorted by date. Not only does that save time, it creates less likelihood of a record being overlooked. In most cases, electronic versions of records are sufficient, as long as they can be easily retrieved and viewed on the computer.

- Interviews: Advise individuals who may be interviewed during the audit about the purpose of the audit. Communicate well in advance of the audit so that employees aren’t caught off guard when they see an individual walking around taking notes and pictures. Prepare your employees; encourage them to cooperate and provide helpful information when asked. Every employee should:

- Be aware of the company quality/environmental/safety/food safety policy and able to state it in their own words.

- Be aware of the quality/environmental/safety/food safety objectives the company has set for the current time period (i.e., what the company is working on to improve the current “state”).

- Understand how they “make a difference” (i.e., how just by doing their jobs, they are following company policy and objectives and impacting performance).

- Be knowledgeable about the procedures and practices required for doing their job properly.

- Schedule: Ask for an audit schedule. This can help you plan for when certain “in-the-know” people need to be available. This can save valuable time—especially for those individuals—and help ensure that those you absolutely need for the audit are available when you need them.

- Be available: Questions often arise during an audit. It is helpful to assure that qualified and knowledgeable personnel are available to answer questions and clarify information during the audit, in addition to being present during the audit debriefing.

- Housekeeping: Good housekeeping puts auditors at ease. Conversely, lax housekeeping is often a harbinger of compliance issues and may put auditors on heightened alert.

- Care of a third-party auditor: Make sure there is adequate work space available for the auditor to review records and other documents—with power, a desk or table, good lighting, and access to internet/email to exchange documents during the audit.

- Confidentiality: If the audit scope involves regulatory compliance and the company has elected to employ audit privilege mechanisms, make sure that all parties are aware of the means to be taken to ensure that audit privilege is preserved (e.g., marking notes and documents, limiting distribution of output, adhering to state-specific requirements).